Question: Are Americans drowning in debt?

A simple question. There ought to be data from which a simple “yes” or “no” can be concluded.

Doing a Web search brings up any number of pages that attempt to answer this question. Most seem to be “yes” and rely on nearly identical data. But is it so simple?

The most frequently seen chart looks something like this1:

[Chart 1]

[Chart 1]

Looking at this it might appear that indeed, Americans are drowning in debt and are in trouble. There is a significant increase in the rate of rise of the debt ratio between the 1980’s and 2007, whereas the ratio remained fairly steady between 1964 and the 1980’s.

The problem with the above chart is that although accurate, it is incomplete. The Federal Reserve Bank of San Francisco provides a document with a more complete chart.2

[Chart 2]

[Chart 2]

What this chart brings in are assets: personal income, real estate, and securities. We can see from this chart that even as debt has increased, assets have also increased. Is this good or bad?

First, part of basic economic theory is that debt is required in order for the economy to grow. There is no incentive for saving or investing if there is no return on it. For there to be return on savings and investing (both are essentially the same) the assets saved and invested must be loaned out. Through the process of debt, the original assets invested are increased.

For a household we need to include in the ROI (return on investment) not just liquid assets (from savings and investing in stocks), but also intangibles such as future earnings power (borrowing for education would fall here), future ability to have a roof over one’s head (mortgage on primary residence), ability to transport one’s self to work (auto loans), and recreational enjoyment to extend the ability to continue working (loan on vacation home). This is leverage, the ability to use one’s assets as collateral to increase their assets, both tangible and intangible.

Not all debt is bad. In fact as I hope I’ve briefly demonstrated, many debts can be good. The problem is when a person or household is overleveraged to the point they are unable to meet their debt commitments. The first chart (debt to income ratio) might imply that is the case, and much commentary on this chart concludes as such. But not all agree.3

My argument is the first chart, although informative and provides tangential data toward leverage, cannot answer by itself whether or not American households are in trouble.

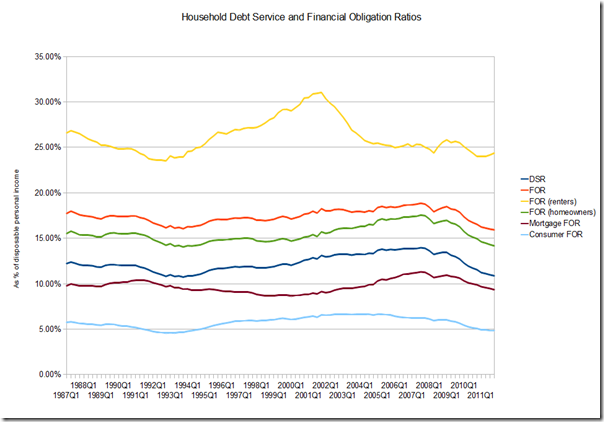

This third chart plots data published by the Federal Reserve.4

This shows the most pertinent data to answer whether or not American’s are drowning in debt. This chart shows how much of personal disposable income is going towards servicing debt. The first chart shows the growth of leverage; this third chart shows the ability to pay for the leverage.

What this shows is that the Debt Service Ratio for all Americans is today as low as it was in the early 1990’s. The same can be said of most of the Financial Obligation Ratios that are plotted. The trend peaked around 2007 but has since been declining. According to this chart then, the answer to “are American’s drowning in debt” is “No.” Americans are well within their means to meet their ongoing debt commitments.

My answer to the original question is a qualified “No” and “Yes.” Americans are not in immediate trouble; they are not “drowning in debt” as some alarmist headlines might have you believe. At the same time the increasing rise of leverage is a concern. If the underlying assets – real estate, securities, one’s ability to earn income – is reduced, the ability to service debts will be affected adversely. If severe enough, then yes, Americans could drown in debt.

A simple question; but the answer? It’s not that simple.

References:

- http://www.moneyreallymatters.com/content/debt-to-income-ratio-and-us-household-debt/

- http://www.frbsf.org/publications/economics/letter/2009/el2009-16.html

- http://economistsview.typepad.com/economistsview/2012/02/the-increase-in-household-debt-prior-to-the-crisis-is-not-a-moral-issue.html

- http://www.federalreserve.gov/releases/housedebt/

No comments:

Post a Comment